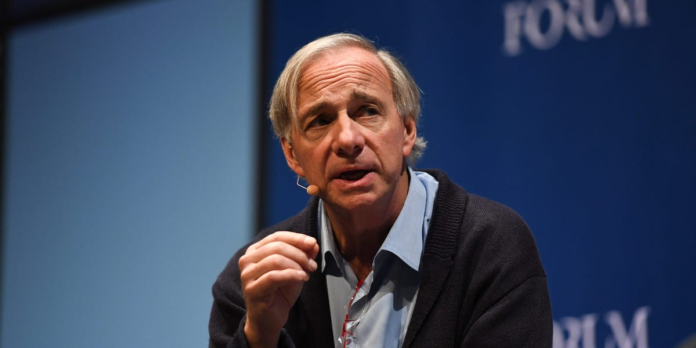

Bridgewater Associates co-CIO Ray Dalio has slammed the US debt limit as “a farce”.

“It works like a bunch of alcoholics who write laws to enforce drinking limits,” he said.

The US hit its $31.4 trillion cap on borrowings last week, raising the prospect of a default in June.

Sign up for our newsletter to get the inside scoop on what traders are talking about — delivered daily to your inbox. Loading Something is loading. Thanks for signing up! Access your favorite topics in a personalized feed while you’re on the go. download the app Email address By clicking ‘Sign up’, you agree to receive marketing emails from Insider as well as other partner offers and accept our Terms of Service and Privacy Policy

Billionaire investor Ray Dalio has slammed the concept of the US debt ceiling – and compared the politicians who want to push it higher to binge-drinking alcoholics who don’t know their limits.

“We all know that there is no real debt limit because what is called a debt limit never actually limits the debt,” the Bridgewater Associates CIO wrote in a LinkedIn post published Wednesday.

“It’s a farce that works like a bunch of alcoholics who write laws to enforce drinking limits,” he added. “When a limit is reached, they do a farcical negotiation that temporarily eliminates the limit which allows them to have the next drinking binge until they reach the next limit at which time they go through the next farcical negotiation and continue to binge.”

The US hit the $31.4 trillion borrowing limit set by Congress last week, forcing the Treasury to step in to prevent a default with “extraordinary measures” including cutting investments into retirement plans.

But those measures will only support public finances until June, with politicians debating raising the limit higher or more creative methods like minting a $1 trillion platinum coin to be deposited at the Federal Reserve to prevent a longer-term default.

Congress has acted 78 separate times to extend the debt limit since 1960, according to the Treasury Department.

That shows that lawmakers aren’t committed to the idea of a ceiling, according to Dalio.

“Not only does this tragically comical ritual lead most people to be confident that the debt limit will be gotten around, but it also tells us that those running our political system lack discipline or they tacitly agree that binge borrowing is OK,” he said.

The US defaulting on its borrowings or even approaching a nonpayment situation could lead to market turmoil and drag the economy into a recession, Goldman Sachs’ top economist warned Wednesday.

“That is the worry: That you get turmoil in financial markets, a big tightening in financial conditions and that adds to downward pressure on economic activity,” Jan Hatzius told CNN.

But constantly extending the limit could also trigger a crisis by undermining global faith in the US as a country that’s willing to pay back its debts, Dalio said.

“The long-term prognosis is for the debt binging to go on until a crisis ends this dynamic,” he wrote.

Read more: A US debt default or even a near-nonpayment could plunge the economy into recession, top Goldman Sachs economist says

Ray Dalio Slams Debt Limit, Compares Politicians to Binge-Drinking Alcoholics

RELATED ARTICLES