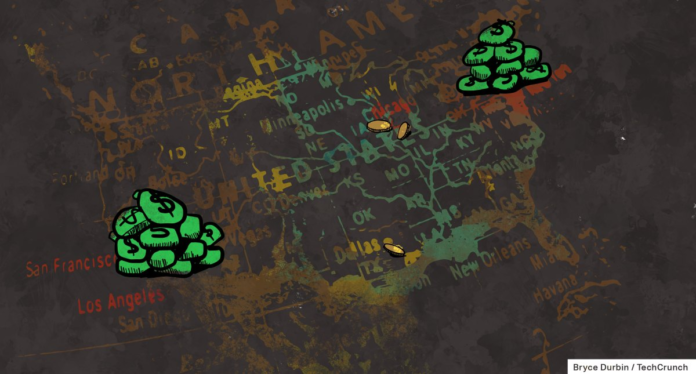

Nearly 80% of venture funds raised in just two states as US LPs retreat to the coasts

Venture capital funds in the United States raised more dry powder in the first three quarters of this year than they did in all of 2021, but it’s not equally distributed: The big funds keep getting bigger while fundraising has gotten harder for the majority of other players. And Q3 data shows that where a firm is based appears to be playing an increasing role.

Through the third quarter of 2022, U.S. venture firms raised $150.9 billion across 593 funds, according to data compiled by PitchBook. While this represents a boost from the $147.2 billion raised in 2021, it marks a staggering drop from the 1,139 funds closed last year.

A lot of these dollars went into legacy or well-established firms, which have the clout to raise mega-funds, though some firms drew in dollars by garnering hype. Consequently, LPs are not as interested in backing firms outside of the established venture hubs this year, marking an unfortunate reversal to the COVID-induced trend of more venture money making its way to emerging ecosystems.