An unprecedented order by the U.S. Treasury to cut off three Mexican financial firms for supposedly helping drug cartels launder funds took effect Monday. But its impact has already swept through the country’s banking industry.

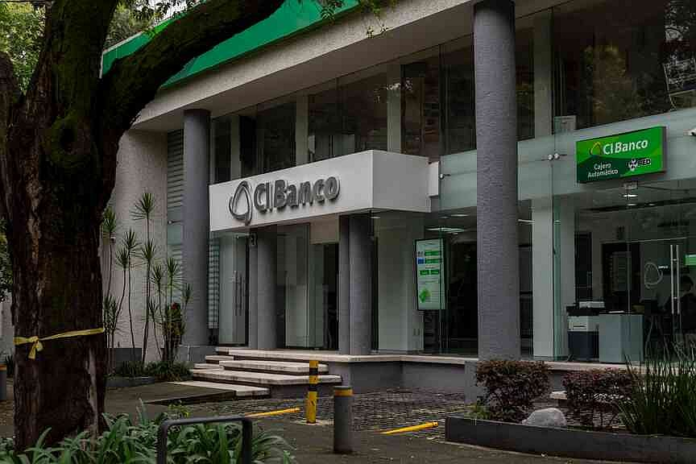

The three designated firms — CIBanco SA, Intercam Banco SA and Vector Casa de Bolsa SA — have been broken up and sold for parts. Their clients have decamped with their business — a big chunk of which was foreign exchange — to other banks or brokerages.

And beyond those firms, the banking system at large is on high alert: Lenders have purged clients, bolstered internal controls and upped communication with both Mexican and U.S. regulators in an effort to avoid becoming the next example of the Trump administration’s crackdown on drug cartels.

U.S. officials have made their intentions clear: There’s a zero tolerance policy when it comes to helping traffickers launder funds connected to America’s fentanyl crisis. The ban on the three firms — announced in June — was the first use of powers given to the Treasury’s Financial Crimes Enforcement Network by last year’s Fend Off Fentanyl Act. High-level Treasury officials have repeatedly visited the country to hammer home the message.