‘You freakin’ idiots’: Dave Ramsey just blasted US universities for promoting online gambling to students — and reaping millions in fees. Why young people are the perfect prey

Sports betting is surging across America — with flashy ads and easily accessible apps encouraging wagers both at home and in stadiums — and has slinked its way over to several college campuses as well.

The New York Times recently uncovered that at least eight universities have partnered with online sports-betting companies, while at least a dozen athletic departments and booster clubs have signed agreements with brick-and-mortar casinos.

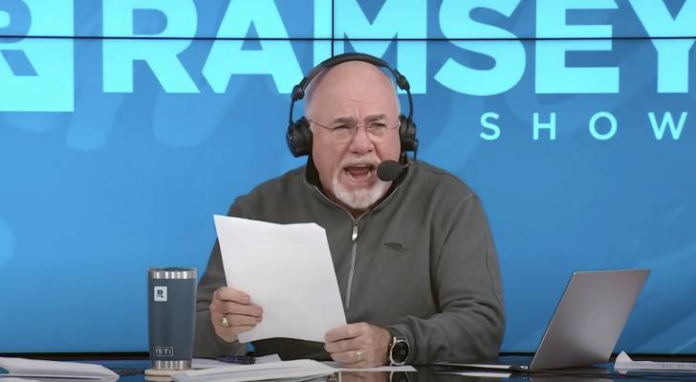

Personal finance author and radio host Dave Ramsey lambasted the institutions on The Ramsey Show.

“You freakin’ idiots … Selling out your own students who you’re supposed to be caring for,” said Ramsey. “The No. 2 addiction in North America today — and fastest growing addiction in North America today — is online gambling. It starts with the sports betting as a gateway drug.”

The National Council on Problem Gambling (NCPG) says researchers estimate about three-quarters of college students gambled in the past year, and 6% have a gambling problem.

Don’t miss

Chances are good you’re overpaying for home insurance. Here’s how to spend less on peace of mind

Mitt Romney says a billionaire tax will trigger heavy demand for this physical asset — get in now before the super-rich swarm

A TikToker paid off $17,000 in credit card debt by ‘cash stuffing’ — can it work for you?

More accessibility means students are more susceptible to problem gambling

In 2018, the Supreme Court overturned a decision that limited sports betting to Nevada — and now 31 states and Washington, D.C. have legalized online or in-person betting, while five more have passed laws that will allow for it in the future.

The relaxation in rules has apparently extended over to higher education institutions as well of late — online betting company Caesars Sportsbook struck a whopping $8.4 million dollar deal with Michigan State University last year, reports The New York Times.

And the University of Colorado Boulder reportedly collects $30 every time someone uses the university’s promotional code to download the PointsBet gambling app and starts betting.

Story continues

The partnerships have helped many athletic departments score back some lost revenue from the COVID-19 pandemic.

However, the colleges have also received criticism for promoting gambling to young adults — some of whom may not even be of legal betting age (ranges from 18 to 21 depending on the state) or who are already burdened with sky-high student debt and have yet to receive relief.

“We believe that the risks for gambling addiction overall have grown 30% from 2018 to 2021, with the risk concentrated among young males 18 to 24 who are sports bettors,” said Keith Whyte, executive director of the NCPG, in an interview.

Whyte has also said that his organization believes the growth of online gambling, including sports betting, has exacerbated the severity and rate of gambling problems, citing a 45% increase in gambling hotline calls and a 100% increase in text and chat communications in the first year after the Supreme Court decision.

The American Gaming Association actually discourages promoting or advertising sports betting on college campuses in its Responsible Marketing Code for Sports Wagering.

Ramsey — who has previously criticized colleges for teaming up with credit card companies — says this new phenomenon is “way worse”, dubbing it “stupidity on steroids.”

What are the risks of a gambling addiction?

Some school-sponsored websites may either downplay the risks of losing or provide incentives such as free bets. But there are plenty of financial risks — especially if students develop a gambling addiction.

There aren’t any visible effects of a gambling addiction, compared with drugs or alcohol, but there are still some major red flags you can look out for, says Diana Gabriele, a gambling counselor at Hôtel-Dieu Grace Healthcare in Windsor, Ont. in Canada.

Spending more money than you initially intended to or siphoning money from other sources to fund your habit is the number-one indicator, she says. Another concerning sign is if your habit starts to impact other aspects of your life, like jeopardizing your significant relationships, career opportunities or education.

Read more: 10 best investing apps for ‘once-in-a-generation’ opportunities (even if you’re a beginner)

Setting firm limits on how much and how often you gamble can help keep you from sliding into risky behaviors. The Canadian Centre on Substance Use and Addiction recommends that you bet no more than 1% of your household income before tax per month, and to restrict yourself to gambling no more than four days a month.

An addict may also find their problem has gotten so big that they can’t cover basic expenses, like their mortgage or rent payments.

The average debt generated by a man addicted to gambling is between $55,000 and $90,000, while women average around $15,000, reports Debt.org.

What can you do to get help?

Experts have concerns that universities may not have enough resources to help students identify or deal with a gambling addiction.

“I don’t see any significant programs put in place — prior to the deal, or part of the deal, or after the deal,” Whyte told The New York Times.

However, the NCPG features a list of treatment centers, self-help tools and helplines by state as a starting point for people seeking help.

When it comes to regaining your financial wellbeing, you may also want to speak to a professional.

Mike Bergeron, a certified credit counselor at Credit Canada, says depending on the severity of your debt, you may want to consider everything from debt consolidation or refinancing your mortgage to filing a consumer proposal or declaring bankruptcy.

You can work with a counselor to create an action plan to live within your means and work on reducing your debt load. For some in the early days of recovery, it might be easier to take some of the decision-making out of their hands and limit their access to money by naming a financial trustee.

What to read next

‘Hold onto your money’: Jeff Bezos issued a financial warning, says you might want to rethink buying a ‘new automobile, refrigerator, or whatever’ — here are 3 better recession-proof buys

Inflation is eating away at Americans’ household budgets — try this investing hack if you’re paying too much for groceries

Here are 3 money moves to boost your bank account right now

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.